abilify-online.site

Prices

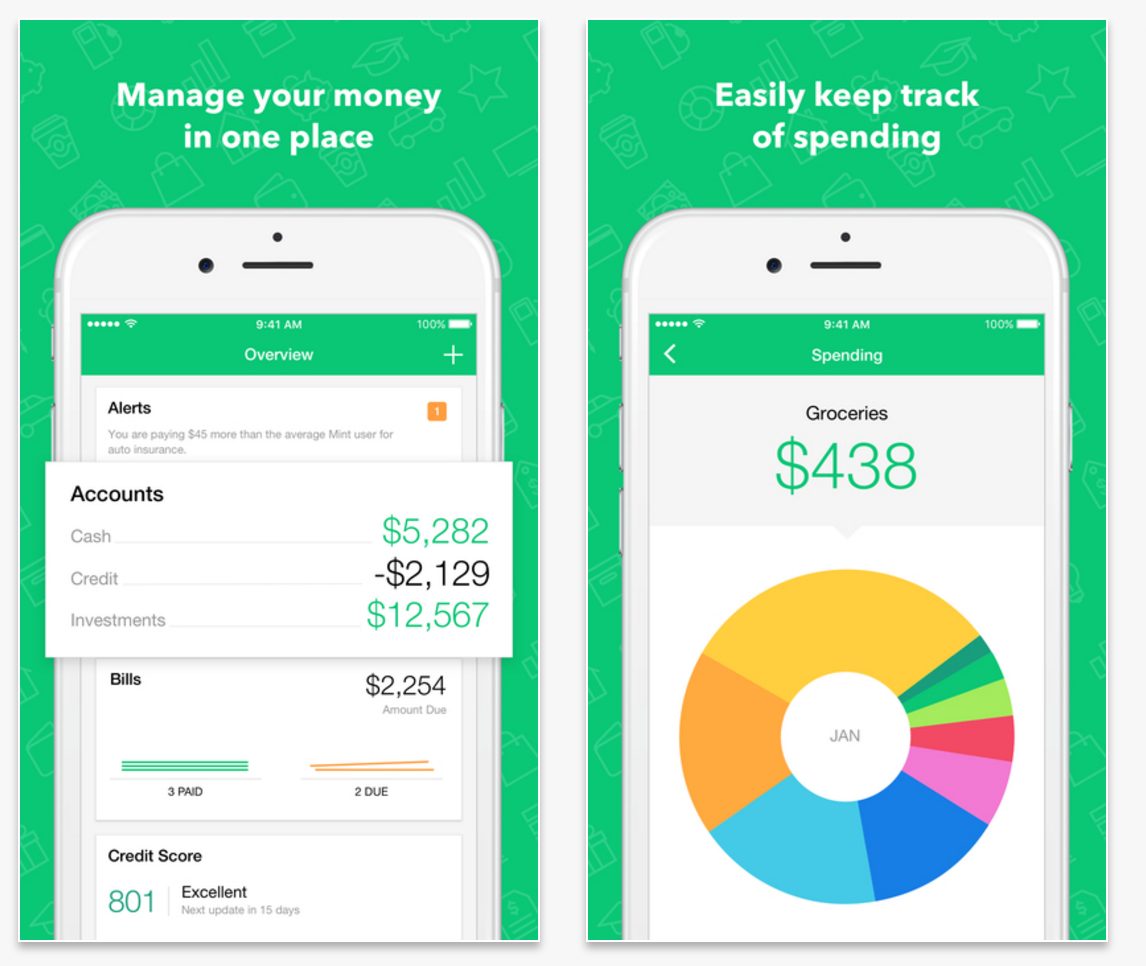

Mint Saving App

Piggy Bank, Savings, Currency. abilify-online.site review: A free budgeting and personal finance app. One of the best money management applications. Reviewed on 17/01/ Pros. Most of my financial accounts and assets are in my app. Credit, checking, savings. Monarch is the true Mint successor if you care more about Net Worth than Budgeting. Read that it has some of the old Mint team. Monarch took. money-saving easier. The application offers Additionally, the Mint app allows for the synchronization of credit cards, bank accounts. Mint is one of the oldest and most popular personal finance apps in the market. It allows users to connect their bank accounts, credit cards, loans, and other. Stay updated with Mint - your ultimate source for business news, stock market updates, and financial analysis. Available now on Google Play Store India. Mint aficionados need not despair because Intuit shuttered the popular free money management app on March 23, Although users are being routed to the. Mint is a powerful, interactive budgeting option that costs nothing to set up and use. Backed by Intuit, the same company that supports TurboTax, the Mint. Mint is an excellent budgeting and financial planning app that's popular because it's free and easy to use. However, it has fairly simple investing features. Piggy Bank, Savings, Currency. abilify-online.site review: A free budgeting and personal finance app. One of the best money management applications. Reviewed on 17/01/ Pros. Most of my financial accounts and assets are in my app. Credit, checking, savings. Monarch is the true Mint successor if you care more about Net Worth than Budgeting. Read that it has some of the old Mint team. Monarch took. money-saving easier. The application offers Additionally, the Mint app allows for the synchronization of credit cards, bank accounts. Mint is one of the oldest and most popular personal finance apps in the market. It allows users to connect their bank accounts, credit cards, loans, and other. Stay updated with Mint - your ultimate source for business news, stock market updates, and financial analysis. Available now on Google Play Store India. Mint aficionados need not despair because Intuit shuttered the popular free money management app on March 23, Although users are being routed to the. Mint is a powerful, interactive budgeting option that costs nothing to set up and use. Backed by Intuit, the same company that supports TurboTax, the Mint. Mint is an excellent budgeting and financial planning app that's popular because it's free and easy to use. However, it has fairly simple investing features.

It also generates interesting tidbits to help you gain insight on your spending and saving habits. Mint took over another app I was using to track bills. Now. No Automated Savings. While Mint allows you to set savings goals and determine how much you can save in a given budget period, it doesn't do the work of saving. PocketSmith is similar to Mint in that you can aggregate all of your banking and investing accounts with one app. From there, you can create custom budgets and. A financial budget app like MINT from Intuit makes “Spend less than you make To promote saving and encourage better personal finance, Mint. The Mint budgeting app officially shut down on March 23, , and users can no longer access their data on the app. We bring together your bank accounts, credit cards, bills and investments so you know where you stand. See what you're spending, where you can save money, and. Funds to Buy · Home · personal finance · How-to-save-money. Six of the Best Budgeting Apps. Popular budgeting app Mint shut down. We've found some alternative. I managed my money from one dashboard, linking my bank accounts, mortgage, credit cards, PayPal and savings accounts to the app. It helped me make a budget . Free personal finance software to assist you to manage your money, financial planning, and budget planning tools I'm saving hundreds of dollars in ATM. They've solved most of the gaps from mint - and it's easy to get a budget set up. I never thought I would be spending money on a budgeting app but this one is. You can use Mint to view your spending trends and monitor progress on your budget. YNAB · How It Works: YNAB helps you proactively manage your money by prompting you to allocate every dollar of your income to expected expenses or savings for. It's a great budgeting and costing app. It lets you see where all your expenditures and savings are and how well you are doing to meet your financial goals. YNAB 4+. Spend, save, and give joyfully. You Need A Budget LLC · # in Finance. If you have bank accounts in multiple countries, it's an excellent app like Mint to consider. savings goals for you, but since then it's grown into a saving. Free to use · Syncs to your bank accounts and credit cards · Users can create savings goals, track investments · Customized alerts when over budget, for large. About abilify-online.site · Mint Alternatives Summary · Best Mint Alternative: Empower · Lunch Money · Power Wallet · Quicken · YNAB · Yodlee MoneyCenter. Mint: The mint finance app lets you connect your bank accounts, credit cards, and other accounts to track your income and expenses. The ultimate budget planner. Advertisements that appear on their website and app; Premium accounts offering credit-report monitoring in exchange for a user fee; Recommendations to save. Mint is a personal finance management tool that helps users track their spending, save money and make more informed financial decisions. Mint pulls all your.

Commercial Real Estate Shares

If you are investing in commercial real estate through a more passive vehicle like a REIT, crowdfunding, partnership, or fund, make sure you are flexible in. Focused on directly originating and managing a diversified portfolio of commercial real estate debt-related investments. Image. ACRE-Video-tablet. Commercial real estate stocks are a type of real estate investment trust or popularly referred to as REITs. These types of real estate stocks buy, own, manage. There are two ways to get involved in the property markets- active and passive real estate investing. When investors personally purchase properties to. Getting started with Commercial Real Estate Investing, or an experienced investor? This is a weekly podcast on the steps that I take to make my Commercial. While many REITs specialize in one form of commercial real estate, you can achieve broader diversification by purchasing shares of REIT mutual funds and ETFs. Here are the steps you need to know when investing in commercial real estate and some tips to get you started. One of the hallmarks of commercial real estate is that they are income producing. Unlike most stocks, which pay no dividends, commercial real estate is defined. An explanation and analysis of what value investing is, how to measure value in commercial real estate and why this approach makes sense for property. If you are investing in commercial real estate through a more passive vehicle like a REIT, crowdfunding, partnership, or fund, make sure you are flexible in. Focused on directly originating and managing a diversified portfolio of commercial real estate debt-related investments. Image. ACRE-Video-tablet. Commercial real estate stocks are a type of real estate investment trust or popularly referred to as REITs. These types of real estate stocks buy, own, manage. There are two ways to get involved in the property markets- active and passive real estate investing. When investors personally purchase properties to. Getting started with Commercial Real Estate Investing, or an experienced investor? This is a weekly podcast on the steps that I take to make my Commercial. While many REITs specialize in one form of commercial real estate, you can achieve broader diversification by purchasing shares of REIT mutual funds and ETFs. Here are the steps you need to know when investing in commercial real estate and some tips to get you started. One of the hallmarks of commercial real estate is that they are income producing. Unlike most stocks, which pay no dividends, commercial real estate is defined. An explanation and analysis of what value investing is, how to measure value in commercial real estate and why this approach makes sense for property.

Looking past short-term volatility is easier said than done, especially when public stock market fluctuations are significant enough to reach the daily news. Commercial Real Estate ETFs are a type of exchange-traded fund that tracks a basket of stocks of commercial real estate companies. These ETFs can be a good way. Listen to Steffany Boldrini's Commercial Real Estate Investing From A-Z podcast on Apple Podcasts. CrowdStreet has helped revolutionize private real estate investing. Our platform connects individual investors with diverse investment opportunities from. A REIT is created when a company or trust pools together investor money to buy and manage real estate properties. Federal Reserve's hint at interest rate cuts boosts real estate sector, with ETFs and stocks of heavily indebted companies experiencing gains. Mar 21, , 2. Commercial real estate market prices are protected thanks to their illiquidity. They will never plummet like the liquid stocks that most investors often go for. In this guide, we break down the essentials of commercial real estate investing, explore the benefits and risks, and provide actionable steps to get you. Discover real-time Ares Commercial Real Estate Corporation Common Stock (ACRE) stock prices, quotes, historical data, news, and Insights for informed. One notable ETF in this space is the iShares U.S. Real Estate ETF (IYR). This ETF seeks to track the performance of the Dow Jones U.S. Real Estate Index and. 7 Ways You Can Invest in Commercial Real Estate Online · 1. Commercial property real estate ETFs · 2. Commercial property real estate mutual funds · 3. Commercial. Commercial real estate investments allow investors to diversify their investment portfolios. There are some differences that set commercial real estate. Investing in commercial real estate involves the purchase or development of properties that have been designed with the intent of housing commercial tenants. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. We estimate the total value of these “REIT-like” properties to be roughly 50% of the total CRE market and that the REIT share of “REIT-like” properties is %. If you want to make an investment that will continue to provide you with passive income over the long term, commercial real estate funds are an excellent option. There are two ways to get involved in the property markets- active and passive real estate investing. When investors personally purchase properties to. Commercial real estate market prices are protected thanks to their illiquidity. They will never plummet like the liquid stocks that most investors often go for. Passive income, capital appreciation, portfolio diversification, and tax benefits are just some of the few benefits which make commercial real estate investing. Commercial properties REITs are real estate investment trusts that specialize in commercial properties. The REITs operate like mutual funds.

1 2 3 4 5